Benazir Program Has Started BISP Savings Scheme 2024

Benazir Income Support Program 8171 has recently launched the BISP Savings Scheme. By the end of 2024, the scheme will cover all those who are eligible. This program is a remarkable initiative. The aim is to empower low-income families. This initiative has now started in many cities and tehsils across Pakistan. And working regularly.

The process of online registration has also started in this program. This program is working regularly in many cities and tehsils including Muzaffarabad Muzaffargarh Peshawar Neelam. Lucky Marwat Qil Saifullah Quetta Multan Lahore Karachi Sukkur Gilgit Khanpur and Mianwali etc.

The process of applying for this scheme is very easy and simple. Read this article carefully to know the complete method. You have been told all the procedures that you can follow to join the new scheme at home. This is a golden opportunity for poor people. So take advantage of this program to improve your life in 2024. The assistance under this scheme will start as soon as the new year begins.

Also Read: GOV PK Announced Double Installment For Benazir Taleemi Wazaif Program

What Is the BISP Saving Scheme?

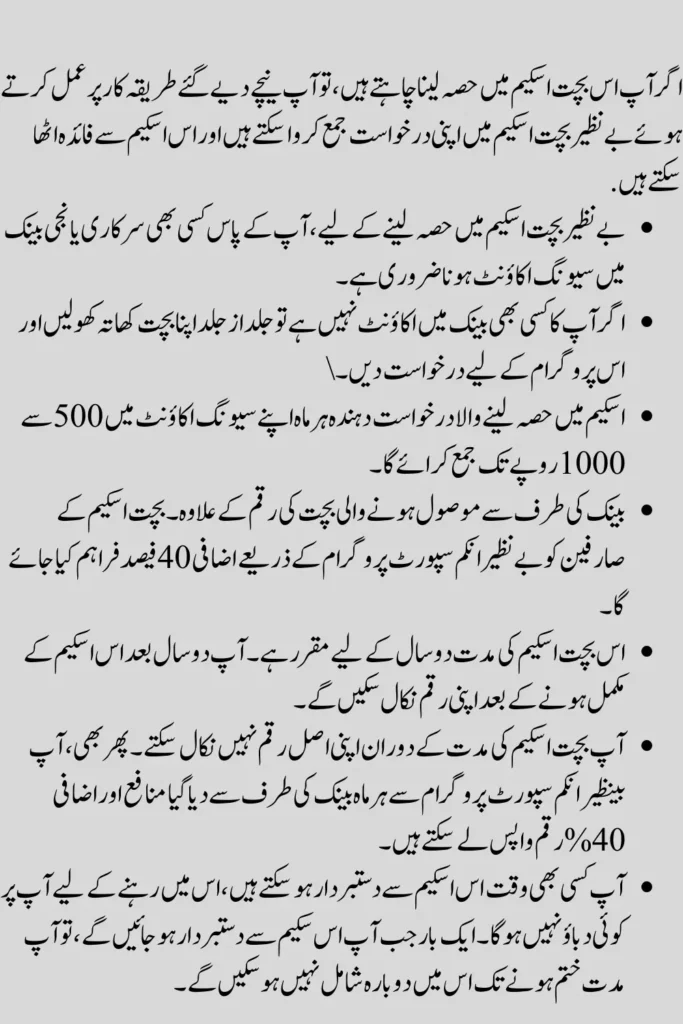

The objective of launching the BISP Savings Scheme is to promote financial independence among the underprivileged. The scheme provides a savings opportunity and enables those with a PMT (Poverty Means Test) score below 40% to participate without facing financial constraints. Currently, the application process is ongoing, and BISP staff is actively collecting submissions from eligible candidates.

BISP Savings Scheme Benefits:

Participants enrolled in the BISP savings scheme are entitled to open a savings account in their name. What makes this scheme unique is that depositors get a remarkable 40% return from BISP on their savings. This incentive not only promotes savings but also acts as a financial incentive for participants, giving them an extra push to achieve their financial goals.

Application Process For BISP New Saving Scheme 2024

To join this transformative program, those interested in the BISP Savings Scheme can follow a straightforward registration process. The government has provided a link that directs applicants to a dedicated portal to apply for the savings scheme. By entering their ID card number and following the instructions provided on the portal, applicants can complete the application process successfully.

Eligibility Criteria

To be eligible for the BISP Savings Scheme, certain criteria must be met. These include a PMT (Poverty Means Test) score of 35% or less, not owning a private house, a monthly income of Rs 10,000 to Rs 20,000, and belonging to a household of up to 7 members. This comprehensive approach ensures that even those with modest monthly incomes, such as Rs 10,000 to Rs 12,000 for a family of three, can participate in the scheme without any hindrance.

Also Read: New Method Of BISP Payment Withdraw From HBL ATM

BISP Check Online By CNIC

For those seeking more information or accessing online BISP services, the program offers an online portal accessible through CNIC (Computerized National Identity Card) details. This user-friendly online platform significantly enhances the convenience and accessibility of the program, providing easy access to BISP services and information.

BISP Savings Scheme for Widows & Laborers

The BISP program is designed with a humanitarian focus, especially to help the laborers and widows whose household lacks a breadwinner or whose monthly income is extremely low. This targeted approach ensures that those most in need of financial assistance are included in the scheme and prioritized.

Conclusion:

In summary, the Benazir Income Support Program savings scheme is a commendable initiative by the Government of Pakistan. Catering to the distinct needs of laborers and widows, it not only provides financial assistance but also promotes responsible financial practices through regular savings. The inclusion of the scheme ensures that people with modest incomes can also benefit, promoting a more just and supportive society overall.